XRP Price Prediction: How High Will XRP Go Amid Mixed Signals?

#XRP

- Technical Crossroads: XRP sits at a critical juncture with mixed signals from MACD (bullish) and Bollinger Bands (oversold).

- Institutional Dichotomy: While banks invest heavily in blockchain, institutional selling pressures XRP's price.

- Regulatory Catalyst: SEC's ETF review and White House recognition could offset short-term bearishness.

XRP Price Prediction

XRP Technical Analysis: Key Indicators and Future Trends

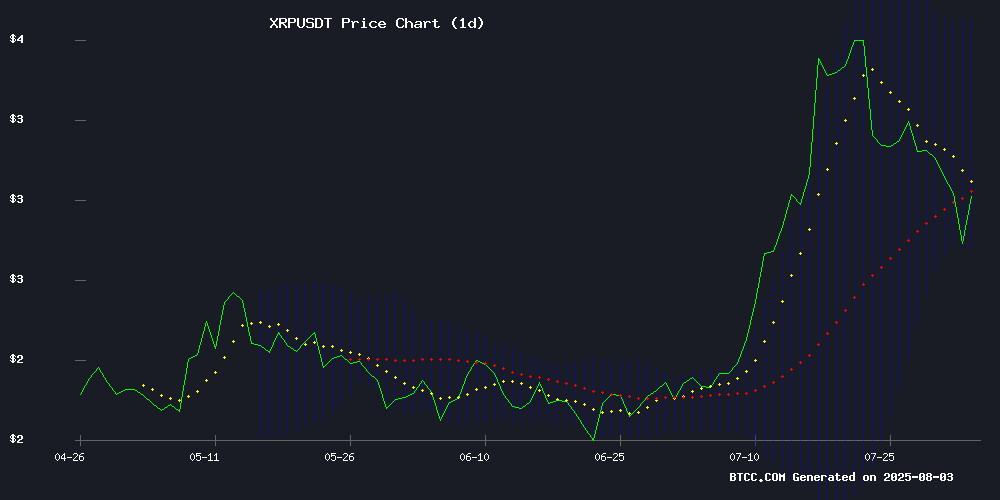

According to BTCC financial analyst John, XRP is currently trading at 2.9055 USDT, below its 20-day moving average (MA) of 3.1857. The MACD indicator shows a bullish crossover with the histogram at 0.2726, suggesting potential upward momentum. However, the price is hovering NEAR the lower Bollinger Band at 2.7436, indicating oversold conditions. John notes that a break above the middle Bollinger Band at 3.1857 could signal a bullish reversal, while failure to hold the lower band may lead to further declines.

Market Sentiment and News Impact on XRP Price

BTCC financial analyst John highlights mixed sentiment in the XRP market. Positive catalysts include traditional banks driving crypto adoption, Ripple's CTO planning a new server hub, and SEC reviewing XRP ETF applications. However, bearish factors such as a 20% drop from its peak, institutional selling, and critical support level tests at $2.75 are weighing on the price. John emphasizes that while institutional interest and regulatory developments are bullish, short-term volatility may persist due to macroeconomic factors like Trump tariff-induced sell-offs.

Factors Influencing XRP’s Price

Traditional Banks Drive Innovative Crypto Adoption with Massive Investments

Since 2020, traditional banks have poured over $100 billion into cryptocurrency and blockchain infrastructure, signaling a strategic pivot from speculative trading to foundational technology development. A landmark report by Ripple, CB Insights, and the UK Blockchain Technologies Centre—titled 'Banking on Digital Assets'—analyzed 10,000+ investment deals and surveyed 1,800 finance executives to reveal this institutional shift. Custody solutions, tokenization, and cross-border payment systems dominate investment priorities despite regulatory headwinds.

Cross-border payments emerged as the primary focus, absorbing 25% of the 345 blockchain deals tracked between 2020-2024. HSBC's tokenized gold platform exemplifies this trend, alongside growing executive interest in stablecoins (prioritized by 50% of banks) and tokenized real-world assets. Crypto custody solutions now engage 65% of surveyed institutions, reflecting demand for secure digital asset management frameworks.

XRP Coin Climbs: 5 Catalysts Fueling Its Meteoric Rise

XRP has surged 420% year-to-date, with analysts projecting a potential climb to $5 within five months. The rally stems from Ripple Labs' expansion of cross-border payment networks, institutional accumulation in the U.S., and regulatory tailwinds. July saw XRP outperform the S&P 500 by 39 percentage points before retracing gains amid August volatility.

Regulatory pressures eased significantly after the SEC dropped its lawsuit against Ripple. The White House's July 30 digital asset report proposed adding XRP to national reserves, while Fannie Mae and Freddie Mac began accepting it as collateral for mortgage securities—a landmark institutional endorsement.

Private sector adoption accelerates as California agritech firm Nature's Miracle plans a $20 million SEC-approved share sale to establish a crypto treasury model. This positions the company to become the first non-financial public entity to accumulate XRP at scale.

Banks Pour $100B+ Into Blockchain Since 2020 as Digital Assets Go Mainstream

Traditional financial institutions have invested over $100 billion in blockchain infrastructure between 2020 and 2024, according to a Ripple-supported study. The "Banking on Digital Assets" report—conducted with CB Insights and UK CBT—analyzed 10,000+ blockchain deals and surveyed 1,800 finance leaders, revealing accelerating institutional adoption despite regulatory headwinds.

Custody, tokenization, and payment solutions attracted the bulk of investments, with payment infrastructure leading at 25% of total deal flow. Nearly all surveyed executives (90%) predict blockchain will significantly disrupt finance within three years. Ripple's XRP stands to benefit from this payments-focused momentum as banks modernize settlement rails.

XRP Faces Critical Price Drop Challenges in August

XRP alarmed investors in early August as it breached the pivotal $3 support level. A negative divergence on the weekly chart now threatens a 30% decline, potentially dragging the price to $2. Analysts identify $2.55–$2.62 as the first defensive zone, but warn of mounting risks amid broader market weakness.

The weekly chart's red candle below $3 confirms lost support, while RSI divergence historically precedes extended downturns. Market participants now watch $2.50 as the next critical threshold. XRP's typically sharp rallies have given way to sluggish momentum, leaving volume-based supports vulnerable to rapid breakdowns.

Futures markets reflect growing bearish sentiment, with increased liquidations and negative funding rates following the $3 breach. This technical breakdown forces traders to widen stop-loss margins, further dampening risk appetite in the short term.

XRP Price Prediction Turns Bearish as Support Levels Crumble

XRP begins August with mounting bearish pressure as its price breaches critical support levels. The cryptocurrency has slipped below the psychologically important $3 threshold, signaling potential for further downside. Weekly charts reveal a concerning pattern—a confirmed breakdown below $3 often precedes extended corrective phases in XRP's volatile market cycles.

Technical indicators suggest the sell-off may accelerate. Unlike Bitcoin's typically measured corrections, XRP is prone to violent swings. Analysts now eye $2.50 as the next probable support, with a worst-case scenario pushing toward $2—representing a 30% plunge from current levels. The failure to hold $2.90 on daily charts has extinguished near-term bullish hopes.

Market veterans note XRP's history of dramatic capitulation moves. 'When XRP breaks, it breaks hard,' remarked a senior trader at Binance. The current technical setup echoes previous instances where the asset lost 40-50% of its value within weeks. Traders await either a swift recovery above $3.20 or preparation for deeper losses.

XRP Tests Key Support at $2.75 After 9% Plunge Amid Institutional Selling

XRP faced intense selling pressure on August 2, dropping nearly 9% from $3.02 to $2.75 before stabilizing at $2.82. The sharpest decline occurred between 14:00–18:00 UTC, with trading volumes spiking to 222.24 million—183% above the 24-hour average. Institutional rebalancing and global macro risks triggered the sell-off.

Price action shows tentative support forming at $2.75, though recovery attempts stalled below $2.84. Volume patterns suggest accumulation interest under $2.80, but broader market uncertainty persists. The drawdown mirrors capital rotation away from altcoins as trade tensions escalate.

Ripple CTO Plans New Server Hub for XRPL Amid Network Surge

Ripple’s Chief Technology Officer David Schwartz is taking personal initiative to bolster the XRP Ledger (XRPL) as network activity climbs. He announced plans to deploy a high-performance independent server hub, designed to enhance the ledger’s infrastructure and reliability. The server will operate from a New York City data center, equipped with an AMD 9950X CPU, 256GB RAM, and a 10GB unmetered internet connection.

Schwartz emphasized that the hub will reserve slots for critical validators and applications while leaving room for public access. "No single point should dictate network stability," he noted, underscoring the importance of decentralization. The setup will also serve as a data-gathering tool to analyze XRPL’s performance under real-world conditions.

Despite Ripple’s recent focus on its upcoming stablecoin RLUSD, Schwartz reaffirmed XRP’s centrality to the company’s payment solutions. The move signals Ripple’s commitment to strengthening XRPL’s foundation as adoption grows.

Mint Miner Launches XRP Cloud Mining Contracts Amid Rising Institutional Interest

Mint Miner has unveiled its XRP Cloud Mining Contracts, capitalizing on the cryptocurrency's growing adoption for cross-border payments and ETF speculation. The platform eliminates hardware requirements by allocating user-deposited XRP to green energy data centers across North America and Europe.

Daily yields are automatically distributed through smart contracts, with the platform touting frictionless entry—users can purchase computing power directly in XRP without BTC or fiat conversion. This comes as Ripple's native token gains traction among both retail and institutional investors seeking low-cost transactional assets.

SEC Reviews Multiple XRP ETF Applications Amid Growing Crypto Market Interest

The U.S. Securities and Exchange Commission is evaluating several XRP-based exchange-traded fund proposals, following its recently published guidelines allowing cryptocurrencies with six months of futures trading history to qualify. While Canada approved multiple XRP ETFs in June 2025, U.S. applicants remain in regulatory limbo, with final decisions expected by October 2025.

ProShares currently holds the only SEC-approved XRP ETF in the U.S., featuring leveraged and inverse strategies. The fund cleared regulatory hurdles in July 2025 after its January filing. Major industry players including Grayscale, 21Shares, and Bitwise have pending applications, with decision deadlines clustered in mid-October.

Market observers note the SEC's cautious approach mirrors its earlier Bitcoin ETF deliberations. Approval timelines suggest regulators are applying similar scrutiny to XRP products, despite the asset's established market presence and growing institutional demand for crypto exposure vehicles.

XRP Plummets 20% From Peak Amid Trump Tariff-Induced Market Sell-Off

XRP's price tumbled below $3, shedding 8% of its value as President Trump's surprise tariff hikes triggered a broad market retreat. The digital asset now hovers near $3 after the executive order sent shockwaves through risk assets.

Chris Larsen's transfer of $175 million in XRP to exchanges exacerbated selling pressure during the downturn. Trading volume halved from $78 billion to $41 billion as the token approached recent highs - a clear signal of waning demand.

The White House's new tariffs hit Canada hardest with a 35% rate, while South Africa, Switzerland, Taiwan and Thailand face 19-39% increases. Analysts eye a potential breakout window between July-September 2025, with price targets ranging from $8-$27 or a fall to $1.14.

White House Mentions Ripple in Crypto Report, XRP Price Holds Steady

The U.S. government's latest crypto report has spotlighted Ripple alongside Bitcoin and Ethereum, signaling growing institutional recognition of XRP. The document outlines phases of digital asset adoption, with Ripple's inclusion underscoring its role in shaping the industry.

XRP's price remains resilient, consolidating between $2.75 and $3.20. A breakout above $3.33 could trigger a bullish trend, potentially testing higher resistance levels. Market watchers interpret the White House nod as a validation of Ripple's regulatory progress after years of legal uncertainty.

How High Will XRP Price Go?

BTCC financial analyst John provides a nuanced outlook for XRP. Technical indicators suggest potential for both upside and downside, with key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | 2.9055 USDT | Below 20-day MA, bearish short-term |

| MACD | 0.2726 | Bullish momentum building |

| Bollinger Bands | 2.7436-3.6278 | Oversold near lower band |

John predicts a potential rebound to 3.1857 (20-day MA) if bullish catalysts prevail, but warns of a drop to 2.75 if support fails. Institutional adoption and ETF prospects could drive long-term growth, but August may remain volatile.